I receive compensation for many links on this blog. You don’t have to use these links, but I am grateful to you if you do. American Express, Citibank, Chase, and other banks are advertising partners of this site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available — instead focusing on miles, points, and cash back (and currencies that can be converted into the same).

Ink Business Preferred℠ Credit Card

This card launched around 8 months ago with a big signup bonus and strong points-earning. But it’s a $95 annual fee card, not a $450 annual fee card.

It comes with an 80,000 Point Signup Bonus: Spend $5000 on your new card within 3 months and you’ll get 80,000 points. As you’ll see below, that can even be enough for a roundtrip business class award ticket between the US and Europe. (Chase points are super valuable because they transfer directly to a variety of airlines and hotels.)

And earning is strong with 3 Points Per Dollar on Travel — that’s airlines, hotels, rental cars, tolls, even Uber — and 3 Points Per Dollar on Shipping and Advertising on Social Media and Search Engines which is great for anyone who advertises on Facebook or Twitter, or who spends money advertising with Google.

Unlike earlier Ink products with bonus category earning capped at $25,000 or $50,000 spending in a year, the cap on this card is $150,000.

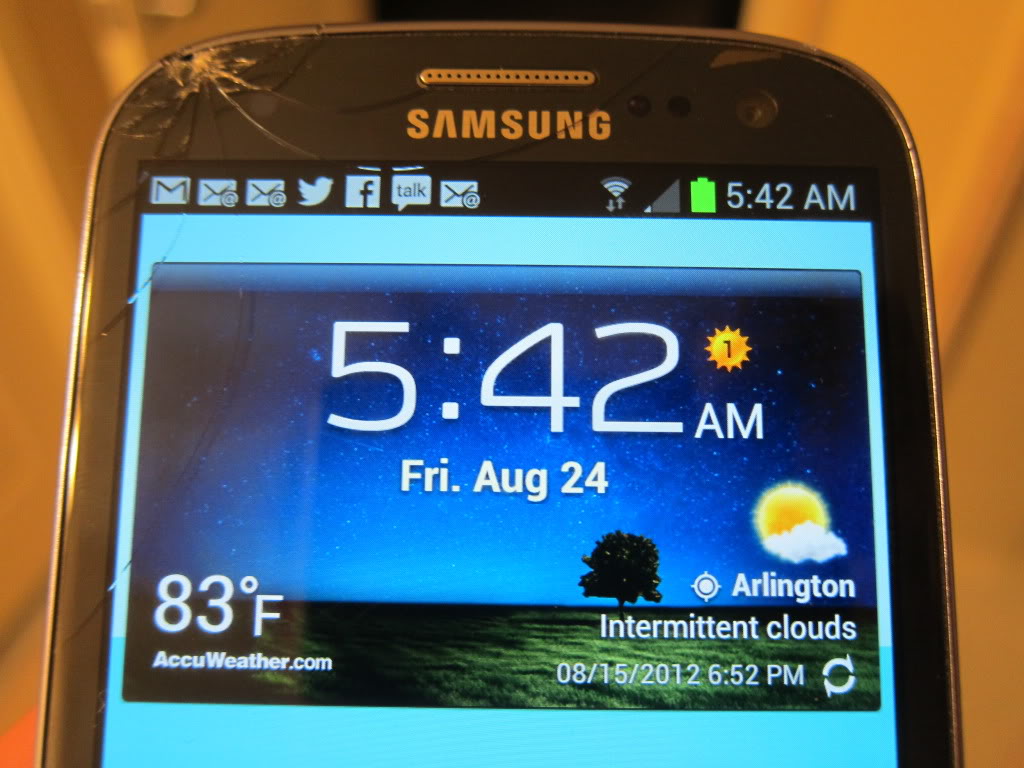

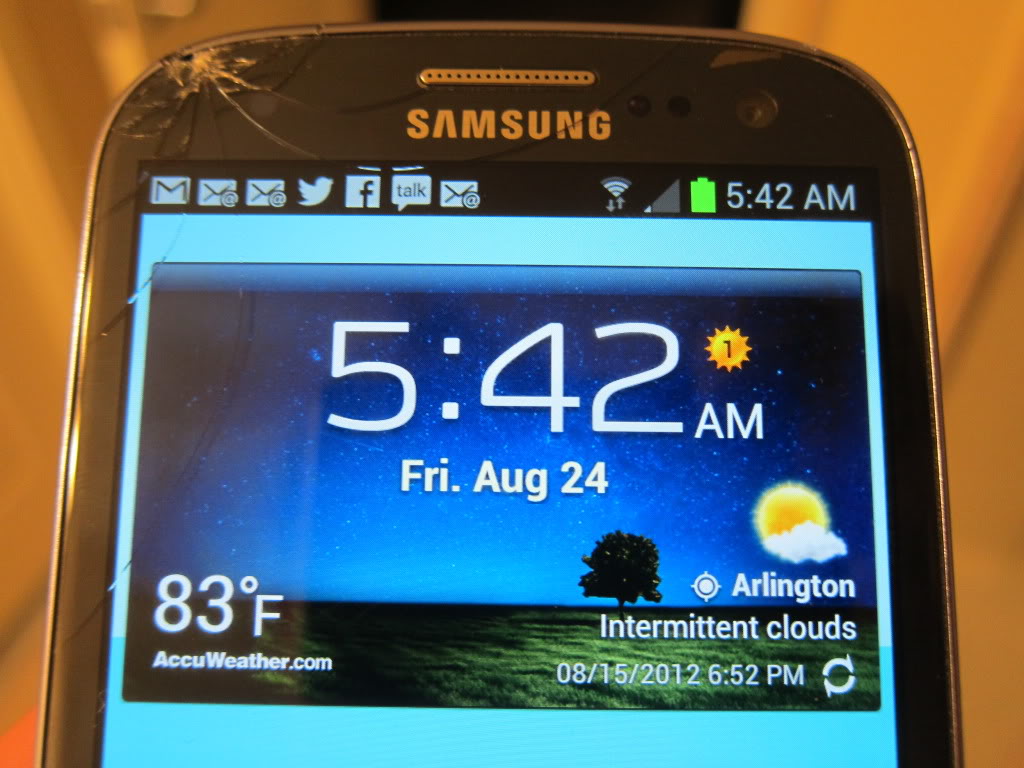

But the biggest reason I want this card is to put my next cell phone purchase on it. That’s because it comes with $600 protection against theft or damage for your cell phone.

Get up to $600 per claim in cell phone protection against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay it with your Chase Ink Business Preferred credit card. Maximum of 3 claims in a 12 month period with a $100 deductible per claim.

I got my cell phone’s cracked screen covered when I paid for it with my Chase Sapphire Preferred Card — but that was purchase protection, cracked the screen shortly after I purchased the phone.

This benefit is significant, it’s real ongoing cost savings, since I view it as replacing a monthly cost for insurance on a phone.

Points transfer to Singapore Airlines, Korean Air, Air France, United, and more. 80,000 Korean Air points are enough for a roundtrip business class ticket between the US and Europe (using airlines like Air France or Delta.)

The rub is that “5/24 limits” apply to the card. That’s not a surprise, there are cards that Chase won’t give to some people who have had 5 or more new cards within the last 24 months.

I’d say that the majority of people who comment on this blog have had 5 or more new cards within the last 24 months and won’t be able to get this card. Although the majority of people who read this blog are not shut out by this and ought to consider it.

Ink Business Preferred℠ Credit Card