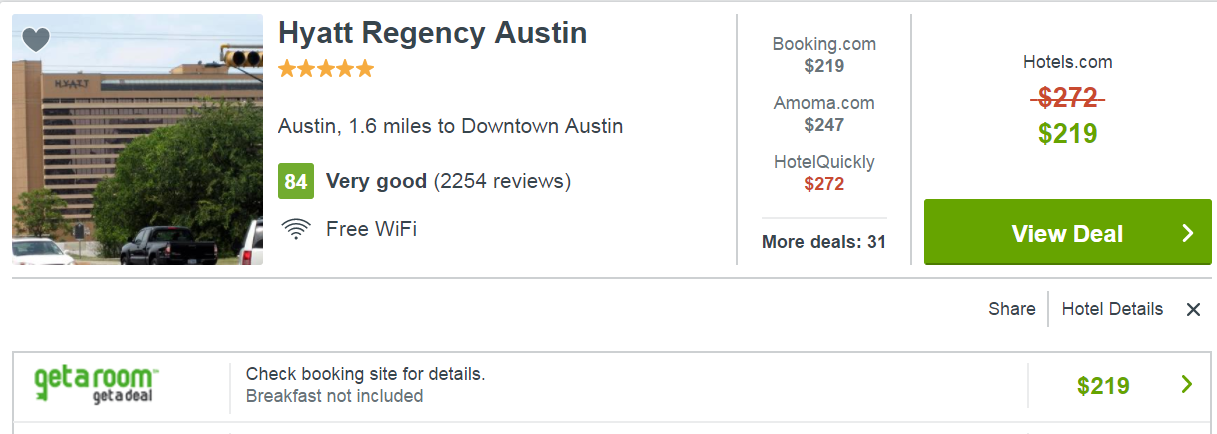

Hyatt informed its hotel owners last week (subscription) that it intends to terminate its distribution agreement with Expedia. This is a negotiating tactic to drive down the commissions it pays. If they don’t reach a new agreement by July 31, then on August 1 we’ll see Hyatt properties disappear from Expedia and related brands (Hotels.com, Orbitz, Hotwire, Travelocity, Wotif).

Expedia Doing the Commission Dance… Flickr: Juggernautco

Hyatt’s note to owners calls this “a powerful step to reduce distribution costs by shifting bookings to lower cost and more flexible channels.” They think they can move more bookings to Hyatt direct channels, and that the World of Hyatt loyalty program can help.

- The program isn’t compelling for most guests, certainly not more compelling than before. It’s arguably better for those who are able to earn top tier elite status. Millions of members see only the program’s earn and burn proposition and that hasn’t changed. Elite levels below top tier are uncompetitive with other chains.

- However one key change is that up through March 1 Hyatt would honor elite benefits (but not offer accrual) on stays booked through third parties. World of Hyatt took this away, the change to the program I hate the most.

- So at most World of Hyatt will shift a small percentage of room nights being booked by its top tier elites away from third party booking sites, although even there it’s not clear that the median top tier member even knows about this change.

Park Hyatt Dubai

At the same time that Hyatt properties may lose some of their business, they’re going to be going to be seeing higher costs and lower payments from the chain.

- Hyatt says, “In support of this sales and marketing plan, Hyatt is reallocating existing budgets, as well as reinvesting money hotels would have otherwise paid to Expedia for its commissions and marketing fund.” Effective July 1 fees for owners of North American full-service properties and select-service properties worldwide increasing 7% (from $1,435 to $1,535 per room per year for North America full-service hotels, 3.5% to 3.75% of rooms revenue each month for select-service properties worldwide). The increase doesn’t apply to full service Hyatt properties outside North America.

- Hyatt properties are likely to see lower reimbursement for reward night redemptions. Hotels are paid a discounted fixed amount per room night redeemed by program members, but receive an override equivalent to their average daily room rate when they’re close to sold out (95% occupancy). Hotels will find themselves hitting 95% occupancy less often.

Hotels that rely heavily on online travel agencies will be significantly harmed in the short term. For U.S. hotels this will skew towards those with strong international demand such as Hawaiian hotels.

Andaz Maui

Apparently though some Hyatt properties have already been harder to find on Expedia (a ‘dimming effect’) because of disputes between Expedia and the chain. Those properties are already receiving fewer bookings, so will be impacted less by this move. Hyatt claims this ‘dimming’ by Expedia hasn’t had a significant effect and convinced them they could escalate things.

Hyatt is telling owners that given commission savings they will only need to replace 80% of business from Expedia to break even (but this would require the replacement business to come at no cost).

So will this work? Commissions are down from where they were a decade ago but are still seen as one of the biggest potentially controllable costs that hotel chains have. Larger IHG wasn’t successful in its gambit with Expedia, and Hyatt is a small player — it’s not clear most Expedia customers would even know they aren’t seeing Hyatt hotel options in most cases (if someone explicitly was looking to book Hyatt they’re not likely to start with Expedia).

However Hotels magazine notes several factors working in Hyatt’s favor:

- The scale of Priceline’s Booking.com, which Hyatt doesn’t give up in picking its fight with Expedia’s brands.

- Metasearch sites drive an increasing number of ‘OTA’ bookings, including bookings made by Expedia’s own sites. Kayak is owned by Priceline, and though Trivago is owned by Expedia they show hotels and pricing from non-Expedia channels as well.

Expedia is likely to take a hard stand though, because if they cave to Hyatt they’re going to see significant pressure from larger chains. Hotels notes that Expedia, with deeper pockets, could outspend Hyatt on keyword search for its own properties.

Ultimately given Hyatt’s size they aren’t big enough to ‘win’ they need Expedia more than Expedia needs them. Both sides lose something not having Hyatt’s properties on Expedia’s booking sites. So Hyatt is likely to be back, not with a major win but with some incremental gain in somewhat lower commission and perhaps more customer data. The question is how long it takes, and how costly it becomes, to get there.